Merchant cash advances can feel impossible to escape. Daily withdrawals drain bank accounts, cash flow becomes unpredictable, and many business owners are left reacting to problems instead of running their businesses.

As pressure builds, it’s common to hear advice suggesting the only way out is to stop paying and deal with the consequences later. While that may sound like relief in the moment, it often creates more problems than it solves.

That kind of advice is usually incomplete — and in many cases, dangerous. Stopping payments without a plan can trigger collections, legal pressure, and long-term damage that limits future options.

While not every situation qualifies for relief, many businesses can exit or restructure merchant cash advance obligations without defaulting, shutting down operations, or destroying lender relationships. The key is understanding why MCAs spiral, what options actually exist, and how to approach the situation strategically rather than reactively.

Why Merchant Cash Advance Loans Are So Hard to Get Out Of

Merchant cash advances are not traditional loans. Instead of flexible payments tied to profit or performance, MCAs rely on fixed daily or weekly withdrawals from the business bank account. These withdrawals are typically set based on assumptions that revenue will remain consistent and predictable over time.

When reality changes, the payment structure does not adjust. Slower sales periods, seasonality, rising operating costs, or stacked advances can all reduce available cash, yet the withdrawals continue at the same pace. This disconnect gradually creates pressure that compounds day after day.

Over time, a cash flow mismatch develops where:

-

Payments are pulled regardless of actual profitability

-

Daily withdrawals hit before deposits or receivables clear

-

Operating cash disappears even while sales continue

At that stage, the issue is no longer whether the business can generate revenue. The business isn’t failing — the payment structure is no longer aligned with reality.

A Step-by-Step Guide to Exiting MCA Loans

Exiting merchant cash advance loans isn’t about stopping payments or taking drastic action. It’s about regaining control of cash flow while protecting your business, your bank account, and your leverage.

Many business owners feel trapped because MCA withdrawals happen daily and decisions are often made under pressure. Without a clear framework, it’s easy to react emotionally or follow advice that creates bigger problems.

This step-by-step guide walks through how to evaluate your MCA situation, avoid common mistakes, and determine whether restructuring or payment relief is realistically possible — before control is lost.

Step 1: Assess Your True Merchant Cash Advance Exposure

The first step is clarity. Before any solution is possible, you need an accurate picture of how much cash is actually being consumed by merchant cash advance payments.

Many business owners underestimate their true MCA exposure, especially when advances are stacked over time. Daily withdrawals often feel manageable in isolation, but combined payments can quietly consume a significant portion of incoming revenue.

A proper assessment should include:

-

Total MCA balances outstanding across all funders

-

Daily or weekly withdrawal amounts for each advance

-

The percentage of average revenue going toward MCA payments

-

How withdrawals impact payroll, rent, taxes, and vendor obligations

Without this information, decisions tend to be emotional and reactive rather than strategic. Understanding true exposure is what turns guesswork into a plan.

Step 2: Understand Why MCA Default Often Backfires

Defaulting on an MCA may feel like immediate relief, but it often reduces leverage instead of improving it. Once payments stop without a plan, control over the situation frequently shifts away from the business.

Unplanned defaults can trigger consequences such as:

-

Escalated collection pressure and increased daily contact

-

Legal action, formal demand letters, or court filings

-

Reduced willingness from funders to negotiate modified terms

-

Loss of control over timing, structure, and resolution options

This doesn’t mean default never occurs. It means default without preparation usually narrows options and increases risk, making long-term resolution harder rather than easier.

Step 3: Determine Whether MCA Restructuring Is Possible

Contrary to popular belief, merchant cash advance payments are not always immovable. While MCA agreements are designed to appear rigid, payment structures can sometimes be modified when existing terms are clearly unsustainable.

In many cases, restructuring becomes possible when maintaining the original payment schedule increases the likelihood of full default. At that point, adjustment can be more practical for both sides.

Potential restructuring outcomes may include:

-

Lower daily withdrawal amounts aligned with cash flow

-

Adjusted payment frequency to reduce account strain

-

Consolidated payment structures across multiple advances

-

Extended repayment timelines that improve predictability

The objective isn’t delay — it’s stability. Sustainable repayment is always preferable to mca drafts draining your bank account.

Step 4: Avoid Common MCA “Quick Fix” Mistakes

When pressure builds, many business owners turn to online forums or informal advice that promises fast relief. Common recommendations often include:

-

Blocking ACH withdrawals

-

Opening new bank accounts

-

Ignoring or delaying funder communications

While these actions may buy short-term time, they frequently escalate the situation. Sudden disruptions often trigger aggressive responses that reduce leverage and complicate negotiations.

Sustainable outcomes come from planned engagement and informed strategy — not sudden, reactive moves. A measured approach preserves options and keeps control where it belongs.

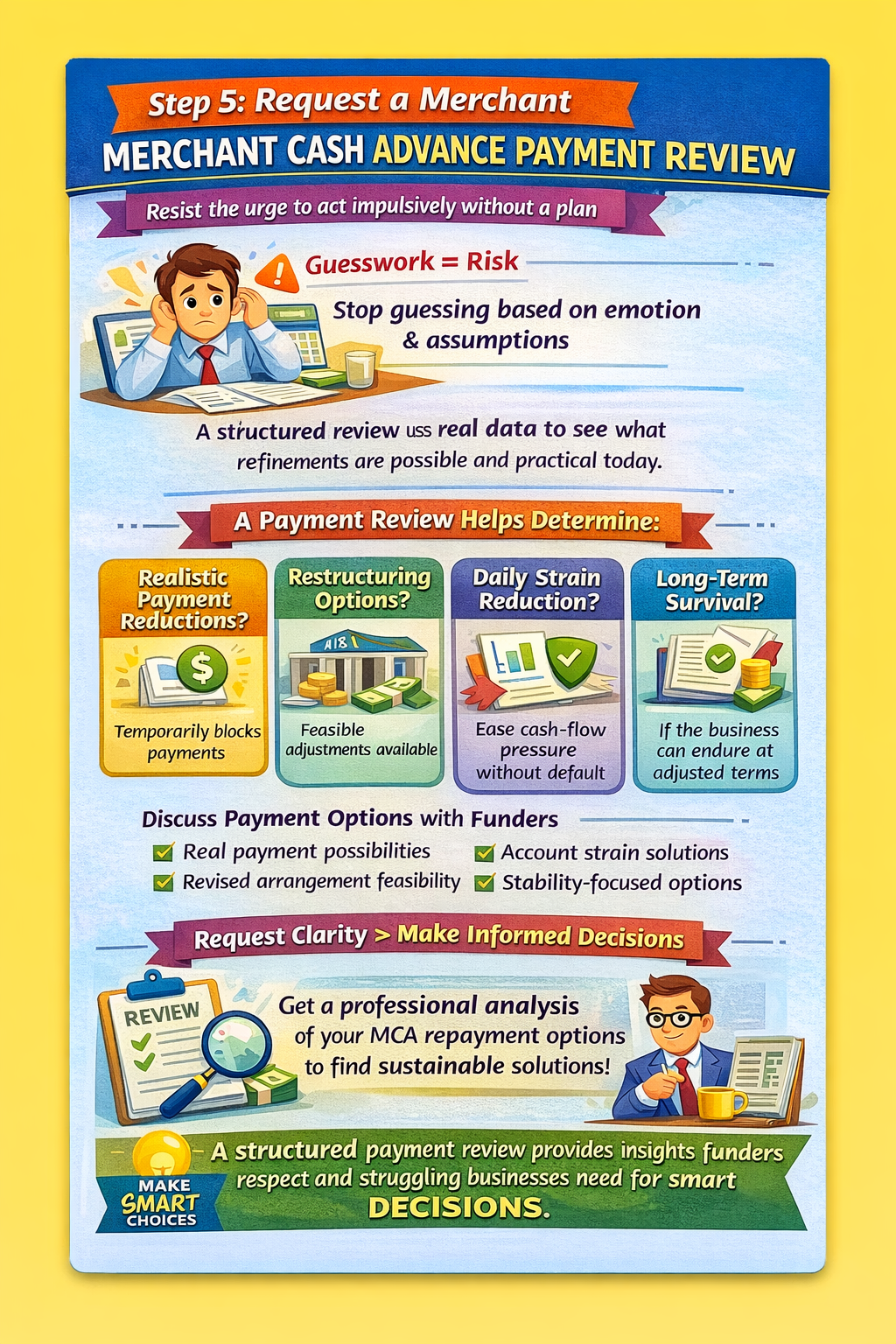

Step 5: Request a Merchant Cash Advance Payment Review

At this stage, guessing is no longer productive. When daily MCA withdrawals are straining cash flow, decisions based on assumptions often lead to unnecessary risk or escalation.

A structured merchant cash advance payment review replaces uncertainty with clarity. Instead of reacting to pressure, this process evaluates the situation using real numbers and realistic scenarios based on how the business is actually performing today.

A proper MCA payment review helps determine:

-

Whether payment reductions are realistic based on current cash flow

-

What restructuring or modification options may exist

-

How to reduce daily strain without triggering default or escalation

-

Whether current payment levels are survivable over the long term

This step is about information — not commitment. A structured review provides a clear picture of available options, allowing business owners to make informed decisions before problems compound or leverage is lost.

The Real Goal: Regaining Control of Cash Flow From Merchant Cash Advance Debt

Getting out of merchant cash advance loans isn’t about “winning” against lenders or abruptly walking away from obligations. The true objective is regaining control of cash flow so the business can operate with stability, predictability, and intention again.

When MCA payments are structured as daily withdrawals, cash flow becomes reactive. Decisions are made based on what’s left in the account rather than what the business actually needs to function. Over time, this unpredictability forces business owners into survival mode, where short-term fixes replace long-term planning.

Once daily MCA withdrawals are reduced, restructured, or brought under control, the entire operating environment changes. Business owners can:

-

Plan payroll and operating expenses with confidence

-

Pay rent, taxes, and vendors on time without constant account pressure

-

Stabilize day-to-day operations and restore internal cash flow rhythm

-

Shift focus from crisis management to recovery and growth

This is the difference between temporary relief and a real resolution. Temporary relief delays the problem. Regaining cash flow control creates breathing room, preserves leverage, and allows the business to make rational, forward-looking decisions again.

Ultimately, successful MCA resolution isn’t defined by eliminating debt overnight — it’s defined by restoring control, predictability, and sustainability so the business can move forward without daily financial disruption.

When to Take Action on Merchant Cash Advance Problems Before Cash Flow Fails

When merchant cash advance payments begin to interfere with basic business operations, delaying action often makes the situation harder to fix. MCA issues rarely resolve on their own, and early warning signs usually appear well before a full financial breakdown occurs.

If any of the following are happening, time matters:

-

Daily negative account balances, even on days with steady revenue

-

Payroll, rent, or tax payments at risk due to insufficient available funds

-

Multiple MCAs withdrawing at the same time, compounding daily pressure

-

Constant overdrafts, returned ACH payments, or failed transactions

These indicators signal that the current payment structure is no longer sustainable. When daily withdrawals consume too much incoming revenue, the business loses flexibility and the ability to absorb normal fluctuations in cash flow.

Taking action at this stage doesn’t mean defaulting or making drastic moves. It means acknowledging that the existing MCA setup no longer aligns with how the business is actually performing. Addressing the issue early preserves leverage, expands available options, and reduces the likelihood of aggressive collections or forced decisions later.

The earlier these warning signs are addressed, the more control the business retains — and the easier it becomes to stabilize cash flow before the situation escalates into a crisis.

Next Step: Get Clarity on Your Merchant Cash Advance Options Before the Situation Escalates

If you’re trying to figure out how to get out of merchant cash advance loans without defaulting, the most productive next step is gaining clarity around your actual options — not making rushed decisions driven by stress or fear.

When daily MCA withdrawals are tightening cash flow, it’s easy to feel pressured into drastic moves that can reduce leverage or trigger unnecessary escalation. Instead of reacting, the goal at this stage is to replace uncertainty with real information.

Requesting a merchant cash advance payment review or savings quote allows you to evaluate whether payment reductions, restructuring, or other modifications may be feasible based on current cash flow and real financial data — not assumptions or generic advice. This process helps identify what’s realistic, what isn’t, and which paths preserve the most control.

There’s no obligation and no commitment required. Just clarity. And in situations involving MCA debt, clarity is often the difference between making a strategic decision and being forced into one.