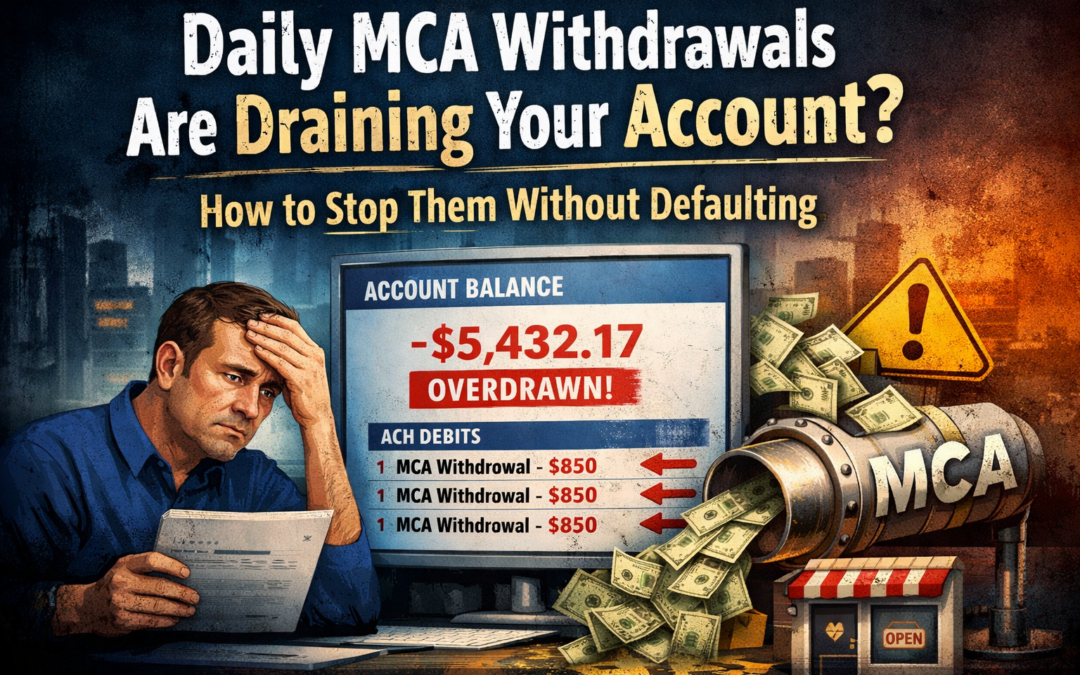

Daily merchant cash advance ACH withdrawals drain cash flow by pulling fixed payments from a business bank account every day, regardless of revenue fluctuations. Over time, these withdrawals often take more cash than a business can realistically sustain, leaving insufficient funds for payroll, inventory, and essential operating expenses. For many businesses, stopping or restructuring daily merchant cash advance withdrawals becomes the only way to restore cash flow stability.

Merchant cash advances rarely cause problems overnight. Instead, pressure builds gradually as daily MCA withdrawals continue unchanged while business conditions shift. What initially feels manageable slowly becomes restrictive, reducing working capital and limiting flexibility.

If your bank balance drops every morning — even when sales are steady — you’re not alone. This is one of the most common and misunderstood challenges businesses face with MCAs. The issue is rarely revenue generation. More often, daily withdrawals remove cash before the business has time to stabilize or adjust.

Daily MCA ACH drafts don’t adapt when circumstances change. Seasonal slowdowns, rising costs, delayed receivables, or short-term disruptions can all reduce available cash, yet withdrawals remain fixed. Over time, daily payments consume an increasing share of incoming revenue, tightening cash flow until the account never fully recovers between drafts.

Warning signs usually appear long before a business feels like it’s failing. These often include waking up to lower balances each day, shifting money between accounts to avoid overdrafts, delaying vendor payments, or taking additional advances just to keep existing ones current. At that point, the problem isn’t mismanagement — it’s structural cash flow pressure created by rigid daily withdrawals.

Unfortunately, much of the advice businesses receive at this stage makes the situation worse. Suggestions to block ACH payments, switch bank accounts, or ignore lenders may offer short-term relief, but they often trigger accelerated collections, legal pressure, frozen accounts, and lost negotiation leverage. Reacting without a plan frequently replaces daily cash strain with long-term financial consequences.

The real objective isn’t to avoid obligations — it’s to regain control of cash flow. In many cases, daily MCA withdrawals can be restructured into a more sustainable repayment approach that aligns with realistic revenue. Effective solutions focus on protecting operational cash, reducing daily strain without default, creating predictability, and preserving lender relationships.

Merchant cash advances don’t drain bank accounts because business owners are careless. They drain accounts because rigid daily ACH structures don’t adjust when business reality changes. Understanding that distinction is what allows real solutions to begin — solutions that restore stability without shutting down the business or burning bridges.

Can You Stop Daily Merchant Cash Advance Withdrawals Without Defaulting?

Yes, in many cases daily merchant cash advance withdrawals can be reduced or restructured without defaulting — but only through a planned, negotiated approach. Abruptly blocking ACH withdrawals or switching bank accounts is usually treated as default. Strategic MCA debt relief focuses on modifying how payments are collected rather than stopping repayment altogether.

Why Daily Merchant Cash Advance Withdrawals Drain Cash Flow So Quickly

Daily MCA withdrawals are not tied to profit. MCA daily ACH payments are fixed withdrawals based on a receivables agreement that assumes steady, predictable revenue. When reality changes — slower sales, seasonality, rising costs, or delayed receivables — merchant cash advance withdrawals do not adjust to match cash flow.

What often begins as a manageable daily draft can quickly snowball into a larger problem. As pressure increases, businesses may take on additional advances just to stay current, creating overlapping payment obligations that strain the same bank account each day.

Common escalation points include:

-

Multiple MCAs pulling withdrawals on the same business day

-

Daily ACH drafts hitting before deposits or receivables clear

-

Frequent overdrafts, negative balances, and bank fee accumulation

Once stacking occurs, daily MCA withdrawals can consume most — or nearly all — available operating cash. Instead of supporting growth, incoming revenue is immediately drained from your bank account, leaving little or nothing available for:

-

Payroll and contractor payments

-

Rent, utilities, and fixed operating expenses

-

Inventory, marketing, or reinvestment

-

Quarterly taxes and compliance obligations

At that stage, the problem is no longer revenue generation. It’s that rigid MCA daily ACH structures are draining cash faster than the business can realistically replenish it, creating a cycle that becomes harder to break the longer it continues.

Why Waiting for Better Sales Doesn’t Fix Daily MCA Payment Problems

Many business owners initially hope the situation will correct itself with a strong sales week or a short-term revenue spike. While increased sales can help temporarily, daily MCA withdrawals don’t slow down or pause simply because a business needs breathing room. Fixed MCA daily ACH drafts continue to pull the same amount regardless of cash flow volatility, often erasing the benefit of improved sales before it can stabilize operations.

As account balances fall lower, the strain on the business bank account intensifies. What may have started as occasional tight days quickly turns into a recurring cycle of account stress that becomes harder to manage with each passing week.

As this cycle progresses, common consequences include:

-

Overdraft and nonsufficient funds (NSF) fees multiplying rapidly

-

Repeated ACH withdrawal attempts hitting the account after failed drafts

-

Increased collection activity as funders flag the account for irregular payments

Once this stage is reached, the merchant cash advance is no longer just collecting revenue — it’s actively destabilizing the bank account itself. Daily withdrawal attempts can disrupt normal cash management, forcing business owners to spend more time reacting to account issues instead of focusing on operations, sales, or growth.

The deeper the account balance drops, the more fragile the situation becomes. Vendors may need to be delayed, payroll timing becomes tighter, and even short interruptions can trigger additional fees or scrutiny. Without intervention, the problem compounds not because the business lacks demand, but because daily MCA withdrawals prevent cash flow from ever resetting.

At this point, waiting for “a good week” rarely solves the problem. Without changes to how withdrawals are structured, the business remains stuck in a cycle where incoming revenue is immediately consumed, leaving no margin to recover.

What Happens If You Stop Paying a Merchant Cash Advances Without a Plan

Some advice online encourages business owners to stop MCA payments abruptly by blocking ACH withdrawals or switching bank accounts. While this approach may provide short-term breathing room, it often creates more serious problems almost immediately. Merchant cash advances are governed by receivables agreements, and sudden payment interruptions are typically interpreted as a default event.

When MCA payments are stopped without a structured plan in place, the response from funders tends to escalate quickly. Rather than creating leverage, an unplanned stoppage often shifts control away from the business owner.

Common MCA default consequences include:

-

Accelerated collection activity and increased daily contact

-

Legal escalation, including demand letters or court filings

-

Heightened MCA legal risk tied to breach or interference claims

-

Loss of negotiation leverage once default is established

At this stage, stopping MCA payments rarely improves outcomes. In fact, it often limits available options by hardening lender positions and increasing pressure on the business. Funders are generally far less flexible once a payment interruption has occurred, especially when it appears reactive rather than strategic.

Defaulting without a plan may also complicate future restructuring efforts. Instead of opening the door to more favorable terms, it can extend timelines, increase legal exposure, and deepen long-term financial damage. In many cases, businesses that stop MCA payments cold turkey find themselves with fewer solutions and greater risk than before.

How Common Reactionary Responses Compare to a Structured Merchant Cash Advance Restructuring Approach

| Action Taken | Short-Term Effect | Long-Term Risk |

|---|---|---|

| Blocking ACH withdrawals | Temporary cash relief | Default, legal escalation |

| Switching bank accounts | Short delay | Frozen accounts, lawsuits |

| Ignoring funders | None | Loss of leverage |

| Structured MCA restructuring | Reduced daily strain | Preserves business & control |

Can Merchant Cash Advance Payments Be Reduced or Restructured?

Despite common belief, merchant cash advance terms are not always immovable. While MCA contracts are structured as receivables purchases, many providers are willing to consider MCA debt restructuring when the existing payment structure no longer aligns with real-world cash flow. The objective isn’t to avoid repayment, but to create terms the business can realistically sustain.

When approached correctly, it’s often possible to modify how payments are collected rather than whether they’re collected. Strategic MCA payment modification focuses on reducing daily strain while keeping the agreement intact and minimizing conflict.

Depending on the situation, possible changes may include:

-

Reducing daily MCA payments to better match current revenue

-

Restructuring repayment schedules into more predictable, manageable terms

-

Consolidating multiple advances into a single payment structure

-

Adjusting withdrawal timing to reduce overdrafts and account disruption

The key difference between success and escalation is how the process is handled. Reactive moves — such as missed drafts or sudden payment blocks — tend to limit options. A strategic approach, on the other hand, preserves leverage, protects the business bank account, and creates room for meaningful negotiation with MCA lenders.

When MCA restructuring is done proactively, businesses often regain control of cash flow without triggering default, legal pressure, or damaged lender relationships. That’s why how the conversation begins matters just as much as the changes being requested.

How to Reduce Daily MCA Payments Without Shutting Down Your Business

Effective merchant cash advance restructuring is built around a single objective: stabilizing cash flow while allowing the business to continue operating. Successful MCA negotiation does not rely on payment stoppages, confrontation, or forcing funders into reactive positions. Instead, it focuses on creating payment terms the business can realistically sustain.

MCA payment reduction options are designed to address the structural mismatch between fixed daily withdrawals and fluctuating revenue. By restructuring how payments are collected — rather than disputing the obligation itself — businesses can relieve daily pressure while maintaining continuity and credibility.

Rather than encouraging defaults or aggressive tactics, structured solutions prioritize:

-

Preserving operating capital needed for payroll, inventory, and expenses

-

Creating predictable, manageable repayment terms that support stability

-

Avoiding unnecessary legal escalation that disrupts operations

-

Maintaining professional lender communication and leverage

When handled correctly, merchant cash advance restructuring allows businesses to regain control of cash flow without shutting down operations or burning lender relationships. The business stays functional, revenue remains intact, and repayment becomes structured instead of chaotic — reducing risk while improving long-term outcomes.

Signs Daily MCA Withdrawals Are No Longer Sustainable

Many business owners try to manage MCA pressure on their own longer than they should, hoping cash flow will normalize on its own. However, certain warning signs indicate that daily MCA withdrawals have moved beyond temporary strain and into a level of risk that requires immediate attention. When these indicators appear, time matters — delays often reduce available MCA relief options.

If you’re experiencing ongoing MCA cash flow problems, it’s a strong signal that outside help may be necessary. These situations rarely resolve without changes to how daily withdrawals are structured.

Common signs you may need MCA help include:

-

Daily negative bank balances or frequent overdrafts

-

Payroll, payroll taxes, or quarterly tax payments at risk

-

Vendors or suppliers going unpaid or being delayed

-

Multiple MCAs pulling daily ACH withdrawals at the same time

-

Constant account monitoring just to avoid fees or failed drafts

When these conditions are present, daily withdrawals have crossed from “tight” into unsustainable. At that stage, the issue is no longer short-term cash management — it’s a structural problem that typically requires formal MCA relief options to prevent further damage.

Addressing the situation early preserves flexibility. The longer daily drafts continue unchecked, the fewer options remain to stabilize cash flow without escalation.

The Real Goal: Regaining Cash Flow Control From Daily MCA Payments

The objective with MCA solutions isn’t simply lowering payments — it’s restoring predictability to cash flow. Short-term relief without structure often leads right back to the same pressure points. True progress begins when daily MCA withdrawals are replaced with repayment terms the business can consistently manage.

Effective MCA cash flow control focuses on creating stability rather than chasing temporary fixes. When repayment is structured and predictable, business owners can stop reacting to daily bank balances and start making informed decisions again.

When daily MCA withdrawals are converted into manageable terms, businesses gain the ability to:

-

Plan expenses and cash needs with confidence

-

Protect day-to-day operations from disruption

-

Allocate funds toward payroll, inventory, and taxes

-

Focus on recovery and growth instead of survival mode

This is where tools like an MCA savings quote become valuable. Understanding what options realistically exist — and which ones don’t — allows business owners to evaluate solutions without guesswork or false promises. Clarity replaces uncertainty, and control replaces chaos.

Regaining cash flow control isn’t about avoiding responsibility. It’s about structuring repayment in a way that supports the business’s ability to operate, stabilize, and move forward.

Can You Stop Daily MCA ACH Withdrawals Without Defaulting?

In many cases, daily merchant cash advance ACH withdrawals can be changed or reduced without triggering a formal default — but only when the situation is handled strategically. Simply blocking ACH withdrawals, switching bank accounts, or stopping payments without a plan is typically interpreted as a default under most MCA agreements and often leads to immediate escalation. However, stopping or modifying withdrawals through structured negotiation or payment restructuring is very different from abruptly cutting off payments.

When approached correctly, the focus shifts from stopping payments to changing how payments are collected. This may involve reducing daily withdrawal amounts, adjusting payment timing, or restructuring repayment terms to better align with actual cash flow. The goal is to relieve daily account pressure while keeping the agreement intact and avoiding the consequences that come with unplanned payment interruptions. That’s why preparation and clarity matter — stopping daily MCA ACH withdrawals without defaulting isn’t about avoidance, it’s about restructuring the payment structure in a controlled, deliberate way.